Key Take-Aways from the February Statistics

The February data is out on the Fraser Valley residential market, and while many of the key metrics are moving in the right direction, showing improvement as we near the Spring market, the growth is softer than one would hope to see. There are, however, some bright spots in the data, particularly in the detached home segment.

Highlights from the February statistics include:

- Detached homes saw another increase in Benchmark Prices when townhouse and condo both decreased again. Check out the pricing chart below that’s clearly showing a turnaround.

- Average days on market dropped significantly for all home types. Detached homes went from 56 days down to 43, townhouse decreased from 38 to 31 days, and condo from 42 to 36.

- Average days-on-market increased for all home types, which is typical in January as listings carry over from an always-slow December.

- An unusual reduction in new listings compared to last month, which February has only seen two other times in the last decade.

- Sales increased 7-12%, depending on home type, which is approximately half the growth rate we would expect in February.

- Active listings ended the month 48% above the 10-year average for the month of February.

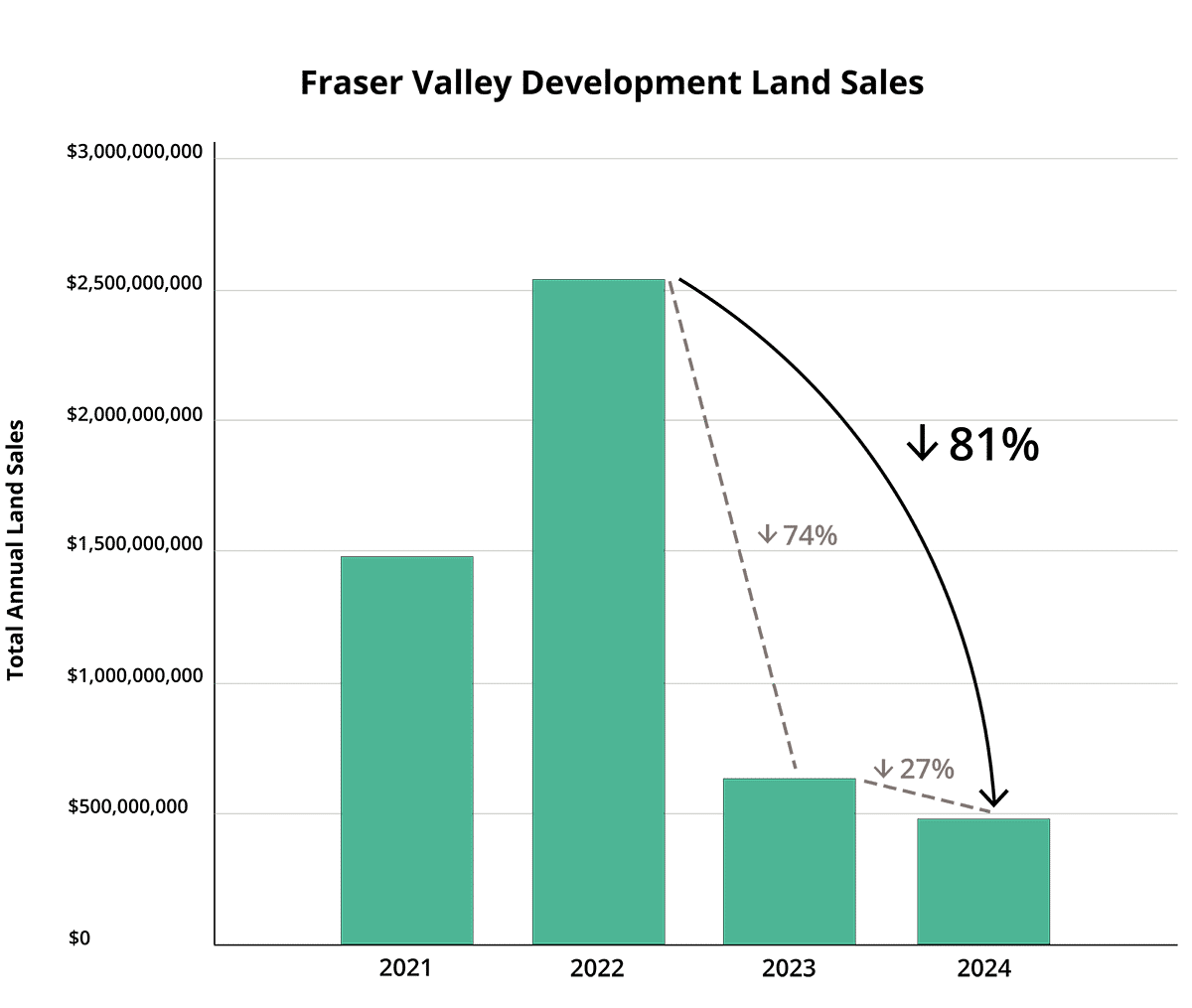

How the Fraser Valley land market is reacting

Over the past month, the most notable theme in the residential development land market in the Fraser Valley is just how wide the sentiment gap has grown between the condo land market and everything else. The contrast has also highlighted how much louder negativity is than positivity. I’ll explain. The typical conversation with developers and builders these days starts with their commentary about how terrible the entire housing market is, how it’s all going to crap, and how they’re apprehensive about acquisitions. Then, it finishes with an upbeat, “Oh, but if you have a good townhouse site, I would be all over that.” The noise in the condo market is drowning out the rest of the market.

Focusing on townhouse land, single family, and even longer-term development land made for an incredibly busy February for us, with buyers in those segments far more optimistic and actually pulling the trigger on deals. There is activity in the condo land space, but the price gap between vendors’ expectations and purchasers’ appetite has grown again, making it difficult to get deals to come together.

The residential development land market is a spotty, mixed bag of sentiment and activity. While this makes it difficult to navigate, it has also resulted in more real acquisition opportunities than we’ve seen in a while.

A snapshot of key metrics

February 2025

Detached homes

The single family detached home market is consistently the first segment to move, either up or down, when the market is shifting. As a result, we look to this segment as an indicator for market directionality and velocity.Home sales in the Fraser Valley

The following charts summarize the month’s total home sales throughout the Fraser Valley.Days on Market

Days on Market is the average length of time listings of that home type stayed on market before selling firm. This metric is an indicator of competition among buyers and the month-over-month change can tell us whether the market is accelerating or decelerating.New and active listings in the Fraser Valley

New listings is the cumulative quantity of listings posted for the month. Active listings is the quantity of active listings on the last day of the month.Listings over time

Listing metrics tend to be seasonally cyclical making month-over-month reports misleading as indicators of market shifts. The below chart shows each month's active and new listings over the past decade. The current month is highlighted on each line to illustrate how today's data compares to the past 10 years of data for the same month.

HPI benchmark prices

HPI Index establishes "Benchmark Prices" for a typical home in each major housing category. Benchmark Prices, as a relative metric, tend to be a more accurate indicator of market direction and velocity as they are not subject to the composition of home types being sold, like average home prices.For more information on the residential development land market in the Fraser Valley or to sign up for my monthly newsletter, please contact:

Mike Harrison

-

- Principal, Development Land Sales

-

- Terrain et développement

.png/9214f10c-2d6f-893a-588c-a32504fc371b?t=1181842726)

Read other Fraser Valley development land news

Data sourced from Fraser Valley Real Estate Board

.jpg/d39f28bc-6580-9bac-f690-5f7202d4b0aa?t=1736295049931)